Indonesia’s financial services industry is undergoing rapid transformation, creating unprecedented opportunities for businesses, investors, and innovators. With a population of over 270 million and one of the fastest-growing digital economies in Southeast Asia, Indonesia is primed for continued expansion in areas such as digital banking, e-wallets, and fintech startups. At Central Insight, we help businesses navigate this dynamic sector, identify profitable opportunities, and achieve long-term success.

Digital Transformation as the Growth Engine

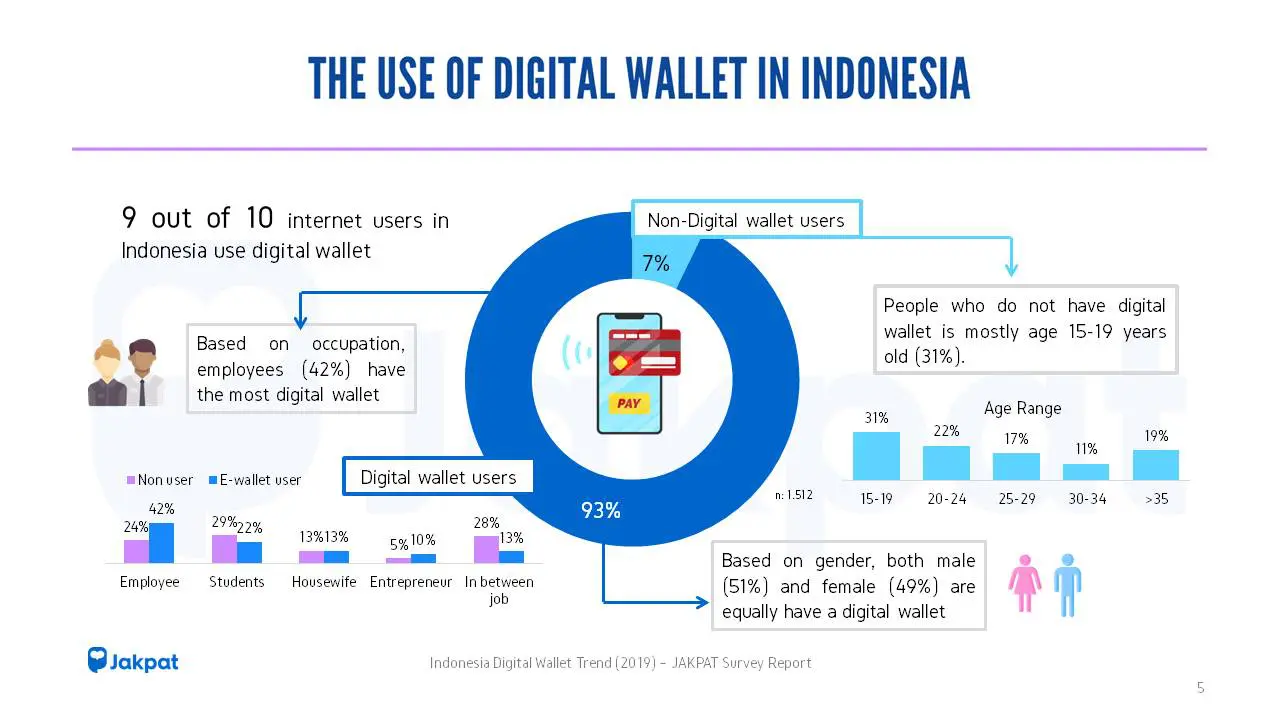

One of the most exciting drivers of change in Indonesia’s financial sector is the rapid adoption of digital solutions. Over 200 million Indonesians are active internet users, and mobile penetration continues to soar. This digital wave has reshaped consumer behavior, particularly in payments and banking. E-wallets such as GoPay, OVO, and DANA have become household names, offering convenience and speed that align perfectly with modern lifestyles.

Fintech startups are also redefining financial access, from peer-to-peer lending to digital investment platforms. In fact, Indonesia is now home to over 300 registered fintech firms, each addressing gaps in financial inclusion, credit access, and wealth management. This rapid growth signals immense potential for businesses that can adapt to the evolving financial ecosystem.

Government Support and Financial Inclusion

The Indonesian government has been instrumental in promoting financial inclusion, a key national priority. With nearly half of Indonesia’s adult population previously unbanked, digital financial services are playing a pivotal role in bridging the gap. Initiatives such as the National Financial Inclusion Strategy (SNKI) have spurred innovation, encouraging banks and fintech companies to bring financial products to underserved communities.

For businesses and investors, this policy landscape translates into a supportive environment for growth. Whether through partnerships with local players, expansion of digital offerings, or investments in fintech, the opportunities are vast and growing.

Why Work with Central Insight?

While opportunities abound, navigating Indonesia’s financial services industry requires deep market knowledge, cultural understanding, and data-driven insights. That’s where Central Insight comes in.

Our team specializes in uncovering profitable opportunities across the financial services spectrum — from digital banking and payment solutions to emerging fintech models. We combine rigorous market research with practical business consulting to help clients:

- Identify growth segments with the highest return potential.

- Understand consumer behavior and adoption trends.

- Navigate regulatory frameworks and government policies.

- Develop entry strategies tailored to Indonesia’s unique market.

- Build partnerships with key local players.

With our guidance, businesses can move with confidence, turning opportunities into sustainable growth.

At Central Insight, we are ready to help you uncover the opportunities that matter most. Let us be your trusted partner in navigating Indonesia’s financial future. Say hello and schedule a free consultation with our team!