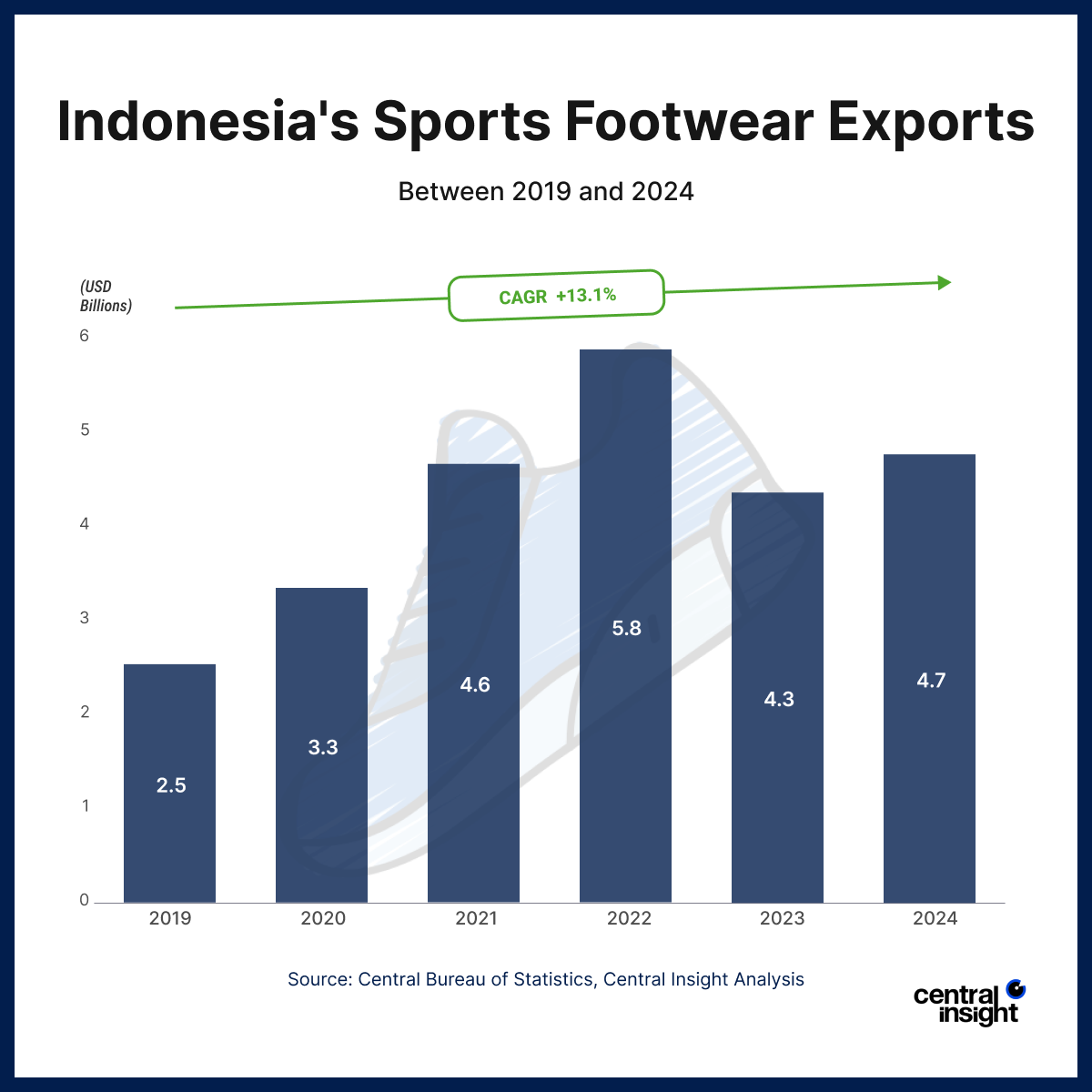

Indonesia has quietly risen to become a global leader in sports footwear exports, ranking sixth worldwide by 2024. Over the past five years, the country’s sports footwear exports have grown with a compound annual growth rate (CAGR) of 13.1%, reflecting the strength of its manufacturing infrastructure, skilled labor, and strategic trade positioning.

Meeting Global Brands’ Demands

This growth story has been driven by several core strengths. First and foremost, Indonesia benefits from a highly skilled workforce, especially in regions like West Java and Central Java, where footwear production is concentrated. These workers, often trained through hands-on apprenticeships, are known for precision, consistency, and adaptability—qualities prized by major global sports brands.

Indonesia’s manufacturing facilities are also highly scalable, offering both large-scale production and flexibility for custom orders. This adaptability has made Indonesia a preferred location for global brands seeking efficiency without compromising on quality.

The country’s pro-business policies and improving trade relationships have further boosted the sector. Agreements like the Indonesia-European Union Comprehensive Economic Partnership Agreement (IEU-CEPA) promise to unlock even more market access by reducing tariffs and easing export processes.

Yet, it hasn’t all been smooth. The industry faced significant challenges in 2023 due to global demand slowdowns and geopolitical tensions, but it is showing strong signs of recovery in 2024, with exports reaching USD 4.7 billion.

Indonesia’s rise in the sports footwear export market is a testament to how investment in people, policy, and production can build globally competitive industries. The challenge now is to sustain this momentum by embracing innovation, managing costs, and strengthening trade ties further.