Indonesia’s healthcare sector is at an inflection point. Fueled by government policy, rising incomes, demographic shifts, and technological innovation, demand for hospitals, clinics, medical devices, and pharmaceuticals is growing strongly. For companies considering entry, expansion, or partnership, now is the moment. But to succeed, you need sharp market understanding. That’s where Central Insight comes in.

What’s Driving the Healthcare Upsurge

Several strong forces are reshaping Indonesia’s healthcare landscape:

Wider access via national insurance: The Jaminan Kesehatan Nasional (JKN) program now covers around 90-98% of the population or about 258-270 million people. This means healthcare, including medical devices and pharmaceuticals, must scale in both public and private sectors.

Medical device sector expansion: The medical devices market reached around US$4.38 billion in 2023. It’s projected to grow to over US$10.47 billion by 2033, with a CAGR around 9.1%. Demand is especially high for diagnostic, cardiology, and general & plastic surgery devices.

Push for local content (“TKDN”): The government has rolled out policies requiring minimum local content in public-procurement devices. Items without required domestic components face restrictions in government tenders. This encourages foreign firms to form joint ventures or invest locally.

Pharmaceuticals and disease burdens: Indonesia continues facing high prevalence of non-communicable diseases (diabetes, cardiovascular disease, cancer). A recent MoU between Bio Farma and Novo Nordisk to manufacture insulin domestically confirms growing commitment in pharmaceuticals and life-saving therapies.

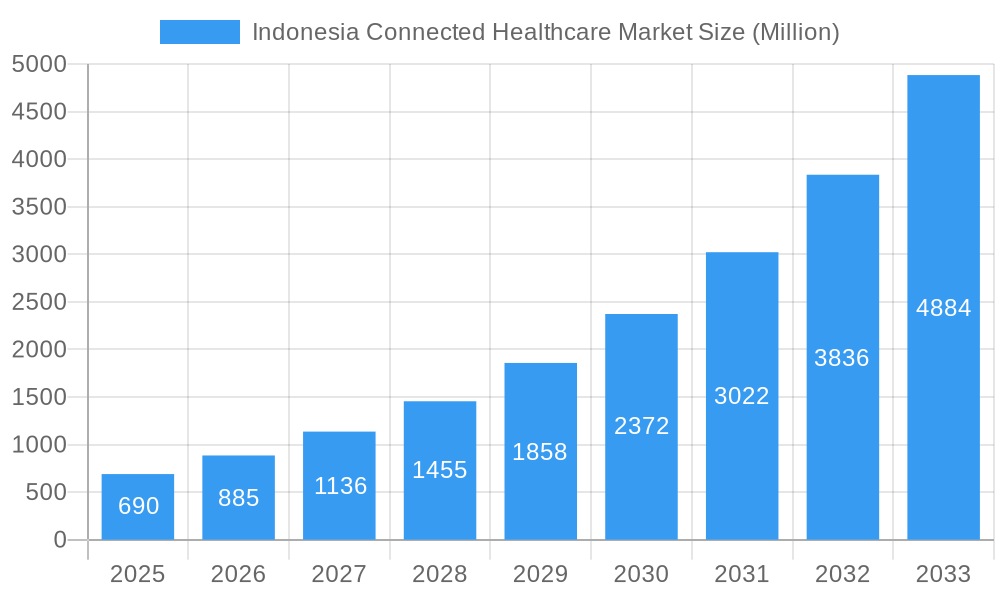

Innovation, digital health & infrastructure: Hospitals and health clinics are modernizing. Telemedicine platforms, wearable health tech, EMR / electronic medical records systems are expanding, especially in urban and semi-urban areas. Regulatory oversight is improving, though barriers remain.

How Central Insight Helps Companies Win

Given this rich and rapidly evolving landscape, successful strategy requires not just facts but context, foresight, and local nuance. Our services are tailored to that. We help you:

Market Sizing & Forecasting

Understand how big each segment is today and how large it will be in 3-5 years. From medical devices, pharmaceuticals, hospital infrastructure, the industry is big. We help you project demand for categories (diagnostic imaging, cardiology, wearables) under various scenarios.Regulatory & Local-Content Strategy

With TKDN rules, import tariffs, regulatory certifications needed (e.g. BPOM, MoH rules), understanding how to comply and benefit from incentives is critical. Central Insight guides how to structure your supply chain, local partnerships, or joint ventures to satisfy requirements.Competitive Landscape Mapping

Who are the main players (local manufacturers, multinationals)? What technologies are they introducing? What segments are underserviced? Where are the gaps (remote areas, high end treatment, chronic disease management)? We map both the strengths and weaknesses of existing competitors.Technology & Innovation Scouting

We monitor emerging trends, like AI in diagnostics, remote monitoring, telehealth, medical device outsourcing, medical device testing services. For example, medical device testing services revenue in 2024 was US$144.1 million and is expected to double by 2030.Market Entry & Growth Strategy

Whether you’re considering exporting, manufacturing locally, building hospitals, or launching new pharmaceutical products, we design actionable strategies: pricing, go-to-market, partnerships, distribution, risk assessment.

Why Now, and Why With Us

The convergence of policy, demand, and capital has made Indonesia’s healthcare space heavily investable. Private equity has shown interest (e.g. Bain Capital’s US$157 million investment into Mayapada Healthcare to expand bed capacity).

At Central Insight, we combine global best practice with deeply local know-how. We are based in Jakarta, we understand regional differences (urban vs rural, public vs private), we speak local language, and we track both official data and on-the-ground signals.

If your company is considering entering or expanding in Indonesian healthcare, whether in medical devices, pharmaceuticals, clinical services, or digital health, partnering with Central Insight means fewer unknowns, smarter decisions, and faster success. Contact us to explore the opportunities, assess risks, and seize growth in one of Southeast Asia’s most promising healthcare markets.