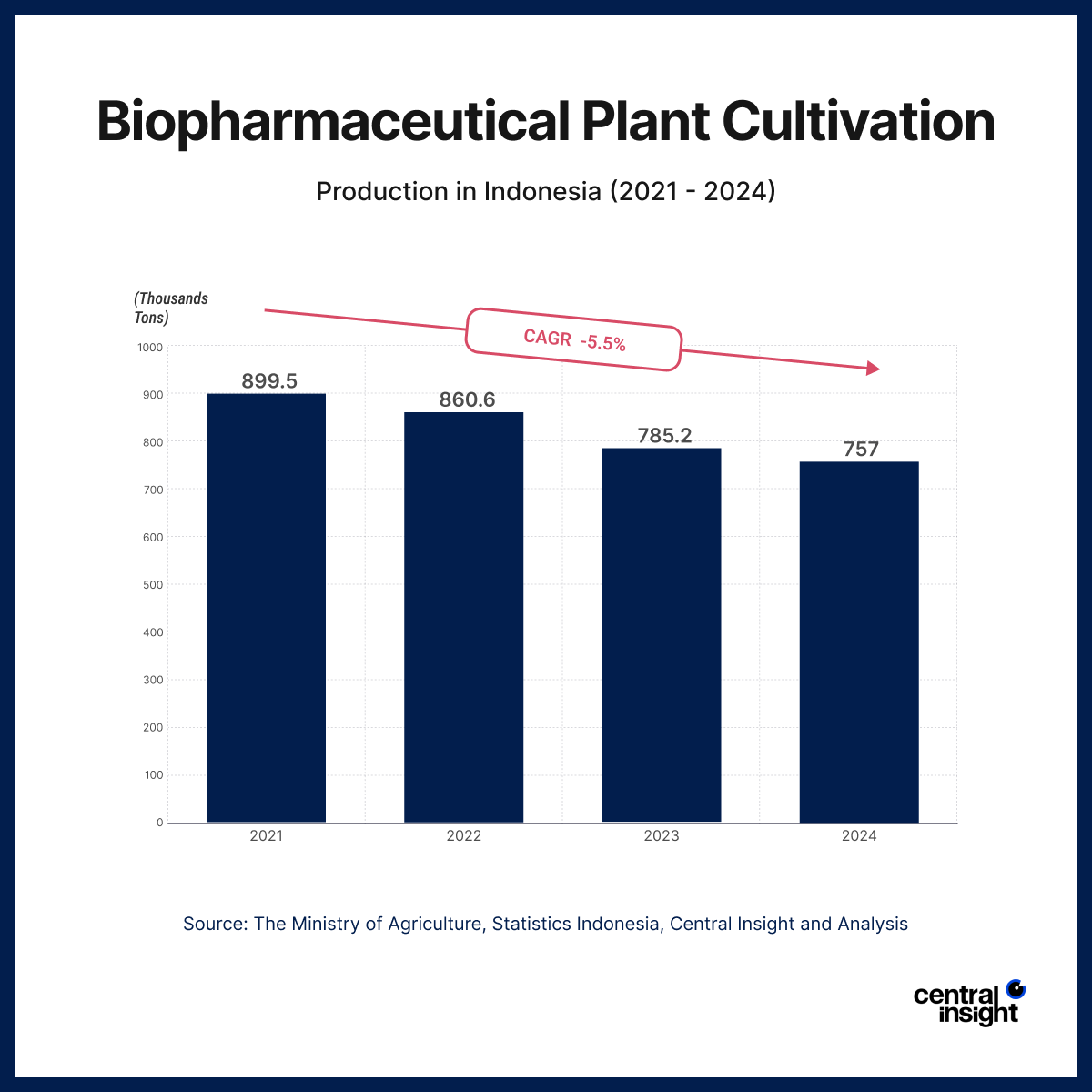

Indonesia’s biopharmaceutical plant cultivation industry has seen a steady decline over the past four years. From 899.5 thousand tons in 2021, total production dropped to 757.0 thousand tons by 2024 or a compound annual growth rate (CAGR) of -5.5%. While the country remains one of Southeast Asia’s significant producers of medicinal and pharmaceutical plants, the contraction signals deeper structural issues.

Key Factors Behind the Drop

Several factors have contributed to this downturn. One of the most significant is the shrinking cultivation area. As more land is repurposed for housing, industrial development, or monoculture crops, farmers are abandoning traditional biopharmaceutical plants due to lower profitability. Crops such as ginger, turmeric, and cardamom require specialized care and long growing periods, making them less attractive compared to fast-harvest alternatives.

Additionally, overharvesting during peak seasons has stressed plant populations, especially in regions with minimal regulation or replanting strategies. This unsustainable practice reduces future yields, leading to a downward production spiral.

Another major issue is the rise in plant diseases and pest infestations. Without adequate agricultural support or access to modern farming techniques, many farmers lack the tools to mitigate these threats. Climate change has also led to erratic weather patterns that damage crops.

With growing demand from the pharmaceutical, health, and cosmetic industries, this declining trend threatens both domestic supply chains and export potential. If not addressed, Indonesia risks losing its competitive edge in the global herbal product market.

A coordinated response is needed: better farmer training, pest control infrastructure, replanting programs, and financial support could help reverse the decline. Supporting this sector is a matter of national economic resilience and public health capacity.