The high-technology propolis market is growing very well. It expands the consumer base from adult-traditional characteristics to young people active in the digital platform who have previously never consumed propolis.

Multipolar Extraction System (MPES) technology not only provides free-wax propolis and nano-sized molecules, which makes it easier to be absorbed, but also a higher quercetin rate. Quercetin is a pigment that belongs to a group of plant compounds called flavonoids. This substrate has been linked to several health benefits, including reduced risks of heart disease, cancer, and degenerative brain disorders.

The rate of quercetin in propolis processed by MPES technology reaches 17%, much higher than natural propolis with a 6% quercetin rate. This technology is more advanced than Nano Technology that provides free-wax propolis and nano-sized molecules, but it does not elevate the quercetin rate.

The price of MPES-propolis is more than double that of Nano-Technology propolis and seven times higher than standard propolis. Many standard-propolis brands are available in the market, and the number of Nano-Technology-propolis are ample. Meanwhile, there are only a few brands of MPES-propolis. Hence, the competition in this market segment is low.

MPES-propolis brands target young people who have high health awareness and savvy digital activities. This kind of consumer’s profile has never been targeted by other brands before. To approach them, the MPES-propolis brands are only using online channels for their sales and marketing. They do not apply either offline distribution or put their products on e-commerce platforms. The consumers are only able to buy the product through their online shops.

Read Also: Entering the Indonesian Market Through Online Channels

This strategy positions the product as an exclusive item for high-level consumers. Therefore, although the price is much higher than propolis processed by other technologies, the MPES propolis growth is higher since the consumers would like to pay more for exclusive and higher quality products. They see the benefit of the products’ specification, i.e high rate of quercetin at a relatively low price, because the price of MPES-propolis is within the price range of top brands of Nano-Technology propolis. Thus, they might acquire higher quercetin rate propolis at relatively the same price as Nanto-Technology propolis.

To support its exclusivity, the management of MPES-propolis provides a hotline where consumers can ask about the products or seek consultation about health. This service is important to support the sales, and at the same time maintain customer loyalty. The support system is a key element that makes these brands succeed in gaining a market share.

It can be summarized that the distribution channel fits the target market and is in line with the after-sales service. Those are like an orchestra that is played in harmony and generates a remarkable result.

Premium vs. Low-End in the High-Technology Propolis Market

As an exclusive product, the market volume will not grow to a large scale of sales volume. Nevertheless, in terms of value, it generates a great margin. And, the orchestra of specific target market, marketing strategy, distribution channel and after-sales service brings this market segment to grow stably and less sensitive to other factors like economic fluctuation that is influencing consumers’ purchasing power. This is the key success factor of the products in the market.

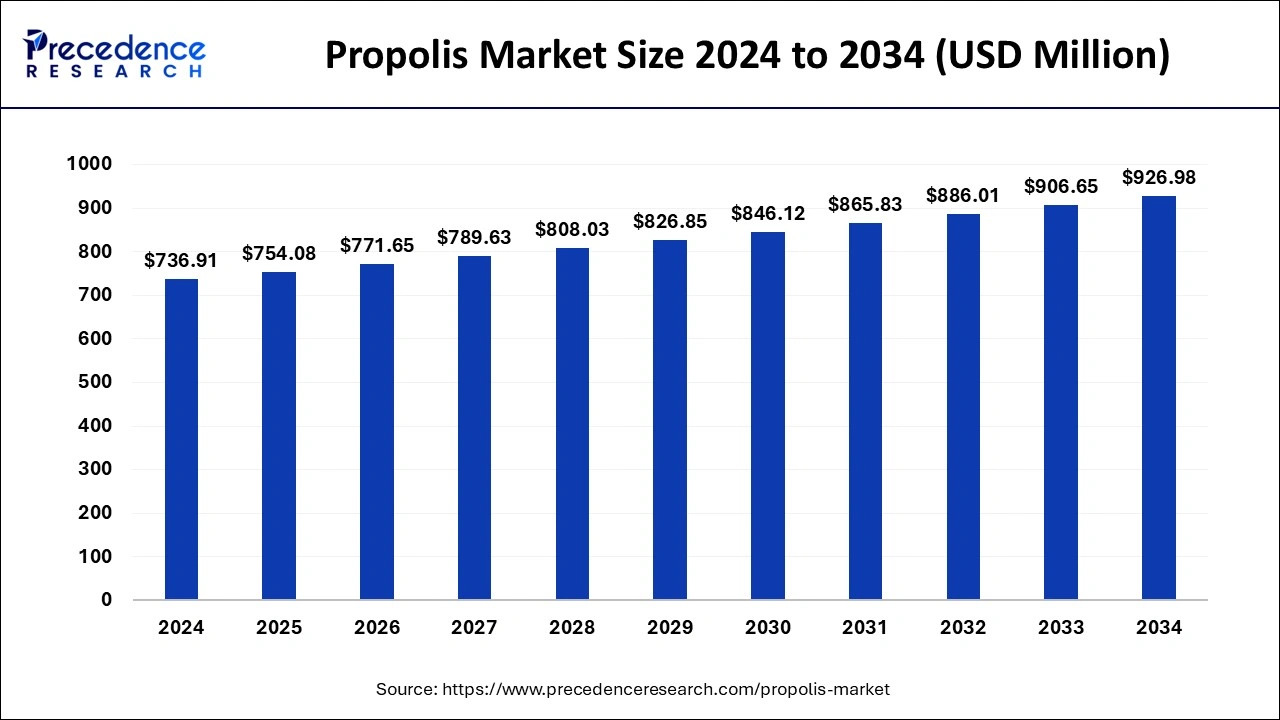

Propolis has been getting popular among Indonesians to maintain health and cure diseases. Indonesia’s propolis consumption has been going up as health awareness and the number of the middle-income class population increase. The trend “going back to nature” also contributes to the rise of the propolis market.

The total value of the propolis market was IDR 2.7 trillion in 2022. During the COVID-19 pandemic, the propolis market size increased significantly as the products are considered to help strengthen the body’s immune system. However, not all propolis categories had the same experience.

The low-end propolis sales shrank due to the decline of low-end consumers’ purchasing power. Contrarily, premium propolis market sales increased significantly. Middle-up consumers even bought more bottles of the propolis, not only for themselves, but also for gifts to their families (parents, siblings, etc).

The popularity of propolis drives the health products (honey, black seed, olive, sea cucumber, etc.), skincare, and personal care products to put this substance as one of the ingredients in their products. The trend to add propolis to various other products also grows.