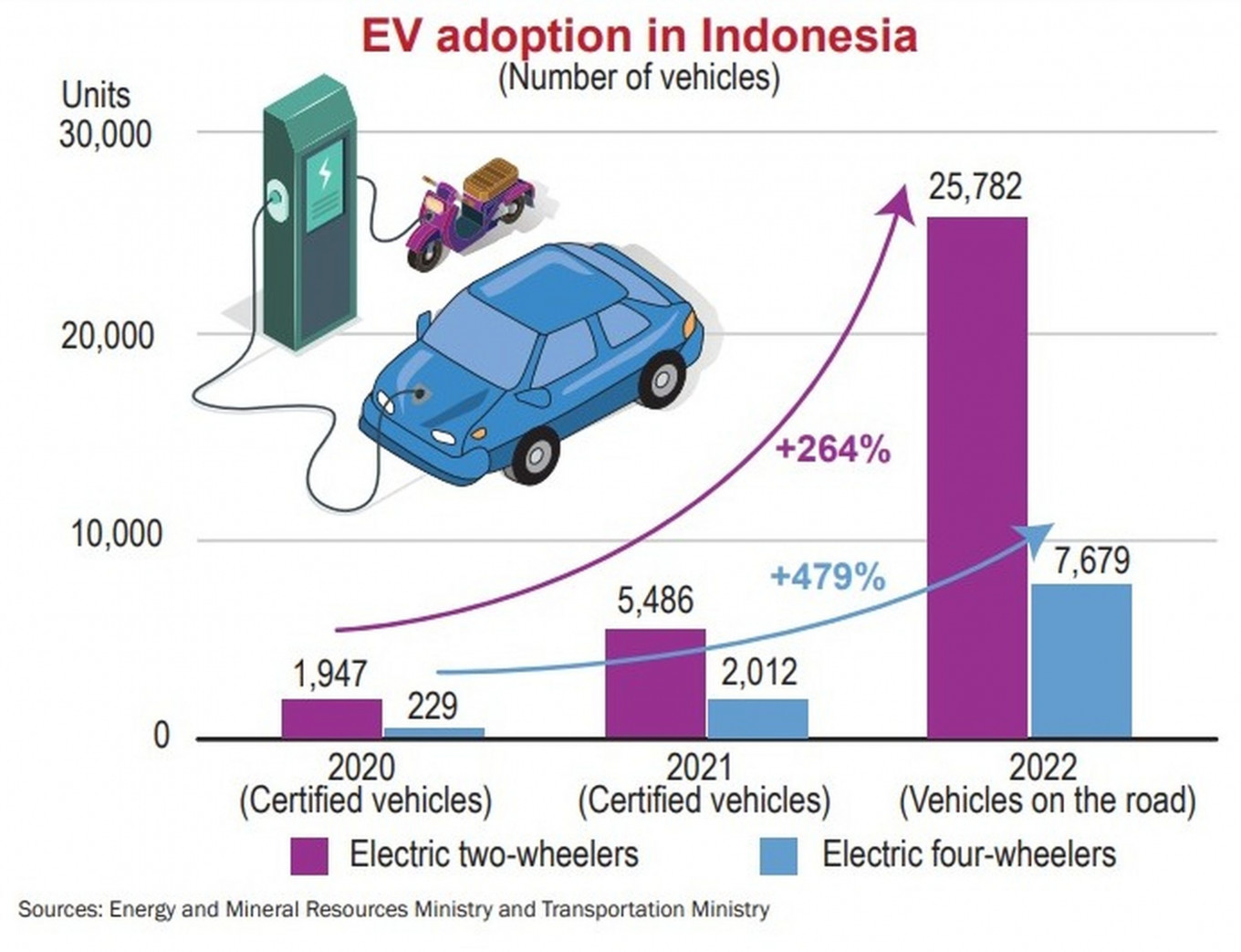

The Electrical Vehicle Charging Station (EVCS) market in Indonesia is wide open as the population of Electrical Vehicle (EV) increases substantially; meanwhile, there are only a few companies developing the infrastructure of EVCS in public areas (malls, restaurants, gas stations, offices, apartments, etc.).

The number of 4-wheel EVs was 7,736 units as of November 2022. It is a tiny number, indeed. Nevertheless, the Indonesian government sets a high target for the replacement of conventional vehicles with EVs. In 2030, it is expected that the 4W EV population will reach more than 2 million units.

From the sales perspective, it is expected that electric cars will comprise 20% of the total car sales, which is equivalent to 400,000 units in 2025 and 25% of the total car sales, which is equivalent to 600,000 units in 2035. This is a big ambition that opens a great opportunity for electrical charging station service business.

Currently, the main player in charging station infrastructure development is PT Perusahaan Listrik Negara (PLN), an SOE electrical producer. On April 2023, the company has developed infrastructure of 616 units of charging stations in the entire country. Most of the EVCSs are installed in their offices network, not in public and business areas where EVs are circulated.

Other players in EVCS infrastructure development are gasoline retailers such as Pertamina and Shell. They are also developing EVCSs in their gas station network; however, the number of available stations is still not many. Pertamina worked with PLN in establishing EVCS. Later on, PLN offered a partnership to all gas station owners to install the charging stations. This offering also addresses all other properties (malls, offices, restaurants, cafés, hotels, apartments, etc.) management, park management, and any other lot management.

There are some EVCS installed to be used exclusively for its groups. For example, EVCS that installed in taxi or buss pools for their own vehicles.

Due to the poor infrastructure of charging stations in public areas, the car maker Hyundai has been developing the charging stations network; otherwise, the consumers won’t buy these Korean cars. Hyundai installed charging stations in its dealer networks. Later on, Hyundai developed charging stations in public areas (malls), but those are inclusive for its cars only; other brands could not use the services. Other electrical cars’ sole agents do the same, namely Mitsubishi and Mercedes Benz; they develop the charging stations for their own brands inclusively in their dealers. Not much different, Lexus develops its charging stations in malls for Lexus exclusive usage.

Contrary, there are only a few independent EVCS service providers. These pioneers have increased the public awareness of public charging stations and hence, their brands are beginning to soar. From a business perspective, they are also one step ahead compared to their competitors (that might enter the market) later on.

Charging an EV in a public area is different compared to doing it at home. At home, the charging process is possible to proceed for hours or even overnight, while in public areas, people might stay a few hours—or even less. As a result, it requires fast-charging technology that needs less than 1 1-hour charging process.

The business prospect of EVCS has a great opportunity in the future. The population of EVs rose sharply when Hyundai manufactured the Iconiq 5 locally and hence reduced the selling price to IDR 748 million (the lowest price), much cheaper than imported ones, which cost more than IDR 1.4 billion. Throughout 2022, the first EV brand manufactured in Indonesia sold 1,829 units.

Wuling Air EV enters the EV market a few months after Hyundai Iconiq 5 on a lower price than Korea’s EV. Wuling launched Air EV at IDR 238 million—on the range of most Indonesian car passenger consumers’ budget when buying a new car, i.e IDR. 200 – 300 million. That’s why, in 2022, the sales volume even beat the Iconiq 5.

Unfortunately, Wuling has not developed a charging station network, so car owners have to rely on independent charging station providers to charge their cars outside their houses.

Therefore, the gap between the EV population and the number of charging stations in public areas will still be an important issue, which means great opportunities for electrical charging services business players.