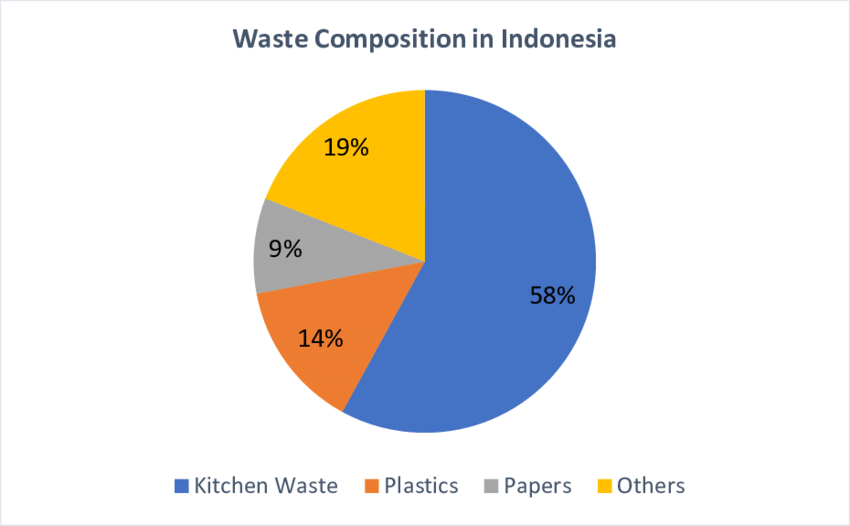

As public awareness of environmental issues increases among society and the government in Indonesia, the demand for environmentally friendly products is growing rapidly. Additionally, there is a significant opportunity for products made from recycled waste materials.

One of them is the building material sector. Either it uses urban waste (from households) or industrial waste.

The type of urban waste used in combination with cement to create bricks is consumer goods plastic packaging. Recently, the Indonesian government enacted a regulation requiring consumer goods producers to help reduce the plastic packaging waste generated by their products. The Minister of Environment and Forestry Regulation No. 75 Year 2019 targets the manufacturing, retail, and food and beverage sectors. This regulation specifically outlines producers’ responsibility to reduce waste by 30 percent by the year 2030. The implementation phase of this regulation began in 2023.

Meanwhile, industrial waste that potentially to be processed to form building panels is textile. Indonesia is one of the key countries in the world when talking about the textile industry. Most of the textile industry waste is not processed to be formed into a new product. Only some of them are used as raw materials for making non-garment products such as doormats, patchwork, dolls, etc. The kind of crafts managed by small and home industries.

A large-scale industry that processes waste textiles does not exist yet in Indonesia. Whereas the raw material, namely defective textiles from production error; is abundantly available since the substantial size of the textile industry in the country.

Read Also: Indonesia’s Textile Industry: A Rollercoaster Ride

The textile waste that is processed to make a new product should pass some tests to make sure that it is safe for humans and does not contain a hazardous substrate. Based on Government Regulation No. 22 of 2021, the test should be conducted by a third party who will objectively make a statement whether it is categorized as hazardous or non-hazardous waste.

Supply chain

Plastics waste from consumer goods packaging is gathered from the end consumers; thus, it needs a collecting system to compile the waste from households to obtain a huge volume of the plastics. Since it’s compulsory by the regulation, the consumer goods manufacturers have built systems for collecting their products’ waste. This supports the raw material procurement for eco-building-material manufacturers. The manufacturers just need to cooperate with the consumer goods manufacturers or the third parties that work for them in collecting their product packaging plastic waste.

Meanwhile, the textile waste building panel manufacturers can directly collect the textile waste from the textile manufacturers. The business process to manufacture the waste into panel building consists of collecting, transporting, storing and processing. Each of the work segments needs a particular permit for hazardous waste. Therefore, it is much more advantageous for the textile waste panel building manufacturers to build the collecting system by cooperating with textile manufacturers that use non-hazardous dyestuffs.

Market opportunity

The public expectation of a clean environment has been increasing, and hence, the demand for eco-friendly products is growing. Meanwhile, the government keeps on strengthening the regulations and actions on environmental issues. For instance, besides the regulation on consumer goods producers’ contribution to plastic waste reduction, the government is preparing a carbon exchange that will be opened soon.

Currently, only a few large companies exist in the economic circular business. Whereas the trend of clean environment awareness continues to increase and has never reached the height as it is recently. Therefore, the market of eco-friendly products is quite promising in upcoming years.