Indonesia’s frozen food industry is rapidly expanding, driven by urbanization, shifting consumer preferences, and a growing reliance on convenience foods. However, the industry faces significant logistical hurdles, particularly in last-mile delivery. With this segment accounting for nearly 49% of total logistics costs, companies must adopt innovative strategies to maintain efficiency, reduce costs, and ensure product quality.

Cold chain logistics is essential for preserving the integrity of frozen food during transit. Given Indonesia’s tropical climate and vast geography, ensuring proper temperature control throughout the supply chain is crucial. Any fluctuations in storage conditions can lead to spoilage, financial losses, and damage to brand reputation.

Consumer Behavior and Market Trends

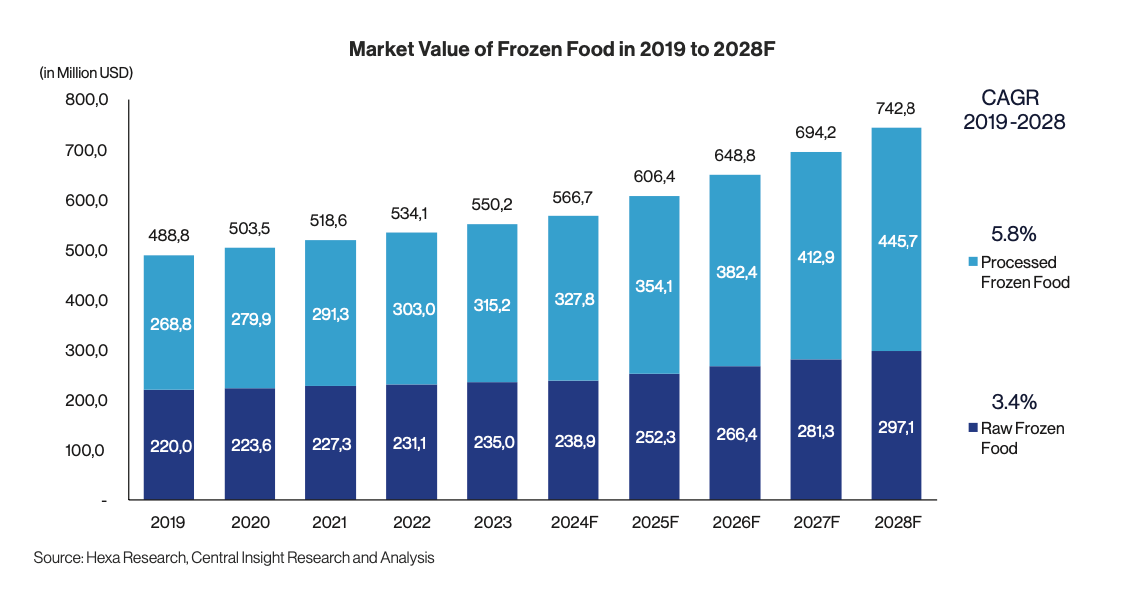

The frozen food market in Indonesia is projected to grow at a CAGR of 7.0% from 2024 to 2028, reaching USD 566.7 million in 2024. A key driver of this growth is the surge in online sales, which are expected to increase at a CAGR of 19.3% over the same period. The demand for contactless shopping and e-commerce convenience is reshaping the frozen food industry, making efficient cold chain logistics more critical than ever.

However, the high costs of last-mile delivery are attributed to several factors, including cold storage, vehicle maintenance, and fuel expenses. Cold storage alone represents a major fixed cost, as maintaining stable temperatures requires specialized equipment and continuous energy consumption. Additionally, inefficient routing, unplanned stops, and fluctuating fuel prices further escalate logistics expenses.

Adopting advanced technologies, particularly the Internet of Things (IoT), is proving to be a game-changer. IoT-enabled systems, such as real-time temperature monitoring, fleet tracking, and route optimization, significantly enhance efficiency and reduce costs. Companies leveraging these innovations can cut logistics expenses by up to 20% while ensuring product integrity.

JAPFA, a leading agribusiness company, has successfully optimized its cold chain logistics through IoT integration. Partnering with McEasy, JAPFA implemented real-time temperature monitoring, door activity sensors, and fleet tracking. These measures led to a 62.5% reduction in product returns and improved operational efficiency.

The Future of Cold Chain Logistics

As Indonesia’s frozen food market continues to grow, investments in digital transformation and IoT technology will be crucial for maintaining a competitive advantage. Companies that embrace automation, smart tracking, and strategic partnerships will be better positioned to meet consumer expectations and drive profitability in the years ahead.

Discover how strong last-mile delivery solutions could shape the future of Indonesia’s frozen food sector in our latest whitepaper.

Authors

Rahayu Widayanti

Widayanti serves as a Partner and Director at Central Insight. Prior to joining Central Insight, most of her experience was in industrial-type research, covering a wide range of industry sectors, including finance, chemicals, healthcare, FMCG, agriculture, textiles, telecommunications, e-commerce, digital technology, and many more.

Rifqi Faisal

Rifqi is a Business Development Manager at Central Insight, with experience as a Research Analyst at a local consulting firm, where he worked on a State-Owned Enterprises project. He was also involved in several research projects during his college years and has a demonstrated history of working in the banking and insurance industries.